The cost of construction labor and material remained elevated in the first quarter of 2023. The cost of fuel and asphalt continued to improve, but the price of steel began to rise. More broadly, inflation continued to improve, interest rate increases slowed, and unemployment remained very low.

Inflation & Interest Rates

Elevated inflation and rising interest rates remained a major issue for the construction market in the first quarter of 2023. Fortunately, the 12-month change in the Consumer Price Index (CPI), a common measure of inflation, continued to decline from 7.1% in November 2022 to 6.5% in December, 6.4% in January 2023, and 6.0% in February. The 12-month change in the CPI for the Atlanta area likewise decreased from 10.7% in October 2022 to 8.1% in December, and 7.2% in February 2023.

The Federal Reserve also continued to raise interest rates in Q1 2023 but at a slower rate. After decelerating its interest rate increases to 0.50% in December 2022 (after four consecutive 0.75% rate increases), the Fed raised rates 0.25% in February and 0.25% in March 2023.

While it appears that these interest rate increases are having the intended effect, 6% inflation remains three times the Federal Reserve’s target of 2%.

SOURCES: U.S. Bureau of Labor Statistics; Board of Governors of the Federal Reserve System

Material Input Costs | Steel

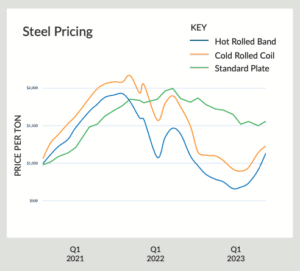

Raw steel prices rose in the first quarter of 2023. Since reaching a two-year low in Q4 2022 ($663 per ton), mill prices for hot rolled band (used to fabricate many structural steel members) increased 71% to close Q1 at $1,133 per ton, near price levels seen in the first and second quarter of last year. Cold rolled coil (used to fabricate decking and panels) likewise increased 37% from its two-year low ($895 per ton, reached in December 2022) to close the first quarter at $1,227 per ton, which is back up to levels last seen in Q3 2022. The price of standard plate, which typically trails the hot rolled band and cold rolled coil market, bottomed out at $1,465 per ton in February 2023 before rising to close Q1 at $1,559 per ton.

Steel joist and deck pricing also rose in Q1. Joist and deck suppliers announced price increases at the end of February 2023, and the aver- age combined price for joists and deck (not including tax) on buildings over 75,000 gross square feet (GSF) rose to $9.90 per GSF by the end of the first quarter.

Finally, raw steel price increases affect other building materials besides structural steel. For example, in the first quarter of 2023 steel pipe manufacturers (used in fire protection sprinkler systems and other trades) announced minimum price increases between 10% and 32%.

SOURCES: Steel Benchmarker; Vulcraft/Nucor; New Millennium Building Systems; Valley Joists + Deck; Canam Steel Corporation