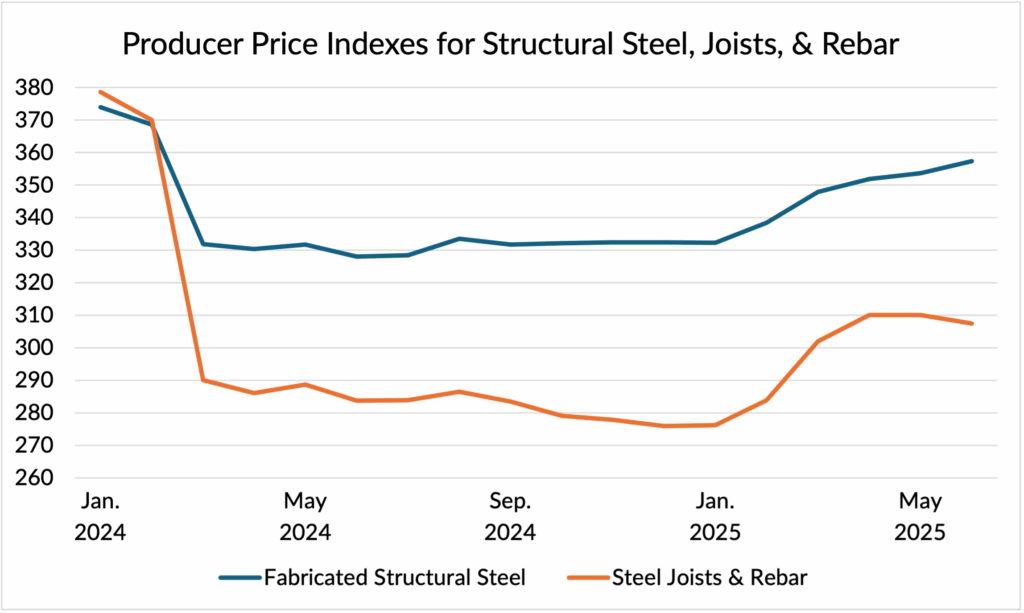

An evolving landscape of tariffs continued to create significant pricing, procurement, and planning uncertainty for contractors, designers, and owners in the second quarter of 2025. While overall inflation remained relatively stable, the cost of labor and steel continued to rise. Unemployment remained low and interest rates were unchanged.

Tariffs

In the second quarter, tariffs implemented and threatened by the United States and other countries continued to affect demand for and the price of both foreign and domestically produced construction materials (as tariffs increase the price of foreign products, demand often shifts to domestic options, raising their price). While the tariff landscape continues to evolve, below is a summary, as of this writing, of U.S. tariffs implemented in 2025.

First, subject to limited exceptions, all products from all U.S. trading partners are subject to a 10% baseline tariff, unless a product or country-specific tariff applies (see Executive Order 14257 of April 2, 2025; Executive Order 14266 of April 9, 2025).

Second, country-specific tariffs apply to products from China, Canada, and Mexico. Imports from China are currently subject to a 20% tariff in addition to the 10% baseline tariff, for a 30% total country-specific tariff (see Executive Order 14195 of February 1, 2025; Executive Order 14228 of March 3, 2025; Executive Order 14298 of May 12, 2025). The United States has suspended higher “reciprocal” tariffs on China until August 12, 2025, as the countries continue trade negotiations (see Executive Order 14298 of May 12, 2025). Products from Canada and Mexico, meanwhile, are subject to a 25% country-specific tariff, with an exception for products that comply with the United States-Mexico-Canada Agreement (USMCA) and certain product-specific exceptions (see Executive Order 14197 of February 3, 2025; Executive Order 14198 of February 3, 2025; Executive Order 14231 of March 6, 2025; Executive Order 14232 of March 6, 2025). Additional reciprocal tariffs for countries other than China, Canada, and Mexico have been suspended until August 1, 2025 (see Executive Order 14316 of July 7, 2025).

Finally, product-specific tariffs are currently in effect on steel, aluminum, and automobile imports. Effective June 4, 2025, a 50% tariff applies to steel, steel derivative products, aluminum, and aluminum derivative products, with a limited exception for products from the United Kingdom (see Proclamation 10947 of June 3, 2025; Executive Order 14309 of June 16, 2025). This is an increase from the 25% tariff that applied to those products since March 12, 2025 (see Proclamation 10895 of February 10, 2025; Proclamation 10896 of February 10, 2025). Effective April 3, 2025, a 25% tariff applies to automobiles (including light trucks, sedans, sport utility vehicles, crossover utility vehicles, minivans, and cargo vans), and effective May 3, 2025, the same tariff applies to certain automobile parts, subject in both cases to limited exceptions for products from the U.K. (see Proclamation 10908 of March 26, 2025; Executive Order 14309 of June 16, 2025).

With the suspension of higher tariffs set to expire in August, and numerous additional tariffs being investigated or threatened by the United States and its trading partners, the tariff environment remains fluid and subject to policy shifts. With most non-residential construction projects taking well over a year to plan and build, these rapid changes have created significant pricing, procurement, and long-term planning uncertainty for contractors, designers, and owners.

SOURCES: The White House; The Office of the Federal Register; Associated General Contractors of America, Tariff Resource Center for Contractors; Reed Smith Trump 2.0 Tariff Tracker

Source: U.S. Bureau of Labor Statistics

Download the Q3 2025 Market Report

Click the button below to view and download the Carroll Daniel Q3 2025 Market Report.