While the prices of many construction materials have plateaued, steel has begun to increase again. The cost of construction labor also continues to rise. In the broader economy, inflation declined, and interest rates were unchanged. The Federal Reserve’s latest projections indicate that it may cut interest rates in 2024.

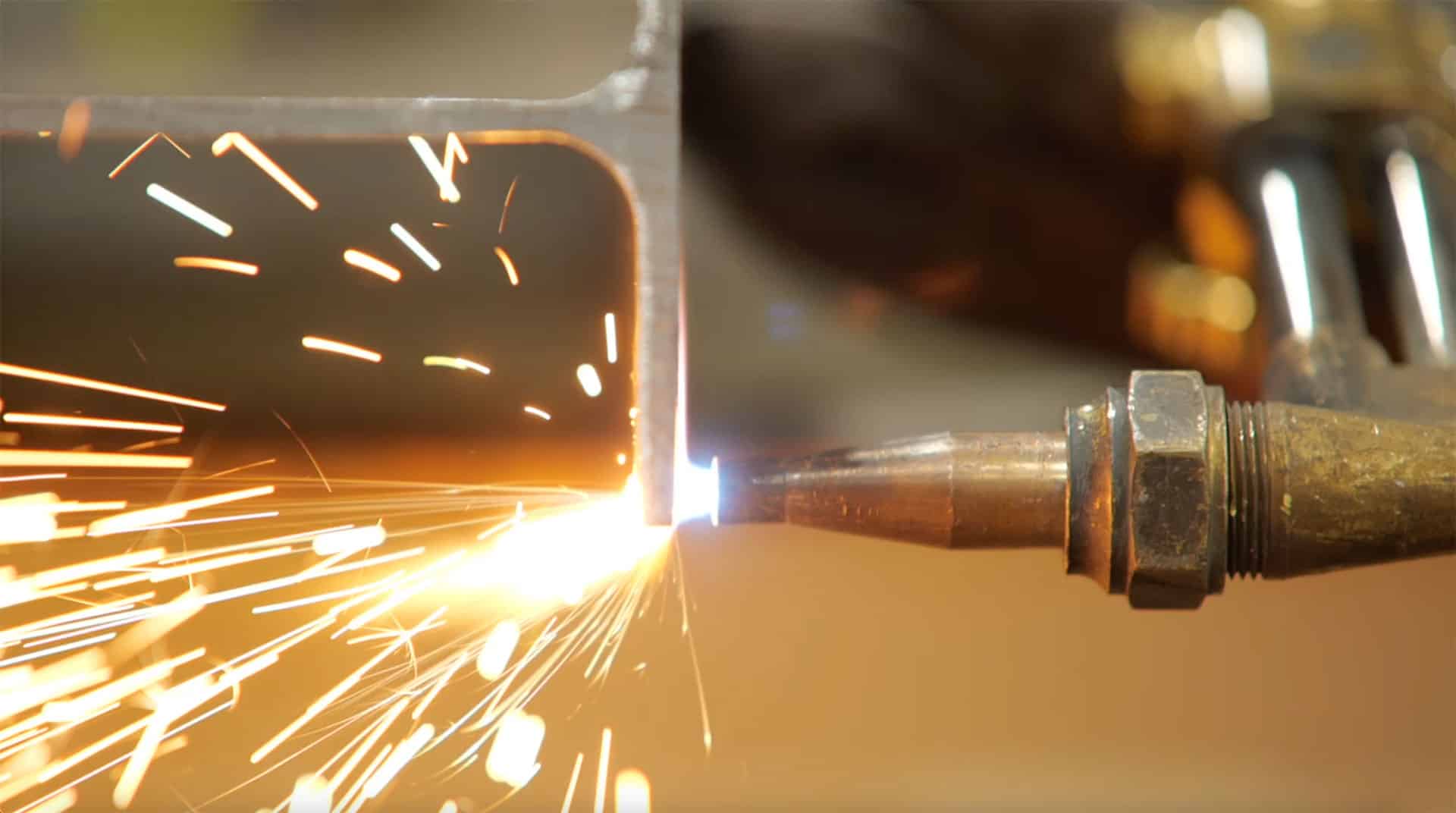

Material Input Costs | Steel

After two quarters of decline, raw steel prices increased in the fourth quarter. The mill price for hot rolled band (used to fabricate many structural steel members) rose 52% in Q4 to close the year at $1,040 per ton, near its 2023 high. The price of cold rolled coil (used to fabricate decking and panels) likewise increased 50% in the fourth quarter to $1,293 per ton, a 2023 high. Finally, the price of standard plate, which traditionally trails hot rolled band and cold rolled coil, declined 4% in Q4 to $1,465 per ton, approximately the same price it was at the start of 2023. The price of joists and deck was unchanged in the fourth quarter but will increase soon. The average combined price for joists and deck (not including tax) on buildings over 75,000 gross square feet (GSF) remained approximately $7.23 per GSF in Q4. In November 2023, however, steel joist and deck suppliers announced a 10% price increase. The current lead time for joists and deck is approximately 16 to 20 weeks. Finally, pre-engineered metal building manufacturers announced 8% to 12% price increases during December 2023. A major steel paint/coatings supplier also announced a 5% price increase effective February 2024.

SOURCES: Steel Benchmarker; Vulcraft/Nucor; Canam Steel Corporation; The Sherwin-Williams Company; Butler Buildings; Nucor Building Systems

Construction Labor Costs

Construction labor costs continued to rise in the fourth quarter. The Employment Cost Index (ECI) published by the U.S. Bureau of Labor Statistics reported a 4.48% YOY increase in construction industry wages and salaries during the period ending Q3 2023, and a 4.06% YOY increase in construction industry total compensation (including wages, salaries, and employer costs for employee benefits) during the same period. For perspective, since 2001, construction industry wages and salaries have increased, on average, only 2.66% per year and construction industry total compensation has increased, on average, only 2.70% annually. Unemployment also remained historically low. The U.S. unemployment rate (seasonally adjusted) declined from 3.8% in September to 3.7% in December 2023. While that rate is 0.2% higher than a year ago, it is 0.2% lower than two years ago, and 3.0% lower than three years ago. Georgia’s unemployment rate (seasonally adjusted) was only 3.4% in November. The unemployment rate (seasonally adjusted) for the Atlanta-Sandy Springs-Roswell Metropolitan Statistical Area (MSA) was also 3.4% in November, while it was only 2.6% in the Gainesville MSA. As of November 2023, Georgia’s construction industry employed 222,300 people, which is 2% more than a year ago.

SOURCES: U.S. Bureau of Labor Statistics; Federal Reserve Economic Data (FRED), Federal Reserve Bank of St. Louis; Georgia Department of Labor

Download the Q1 2024 Market Report

Click the button below to view and download Carroll Daniel Construction’s Market Report for Q1 2024.