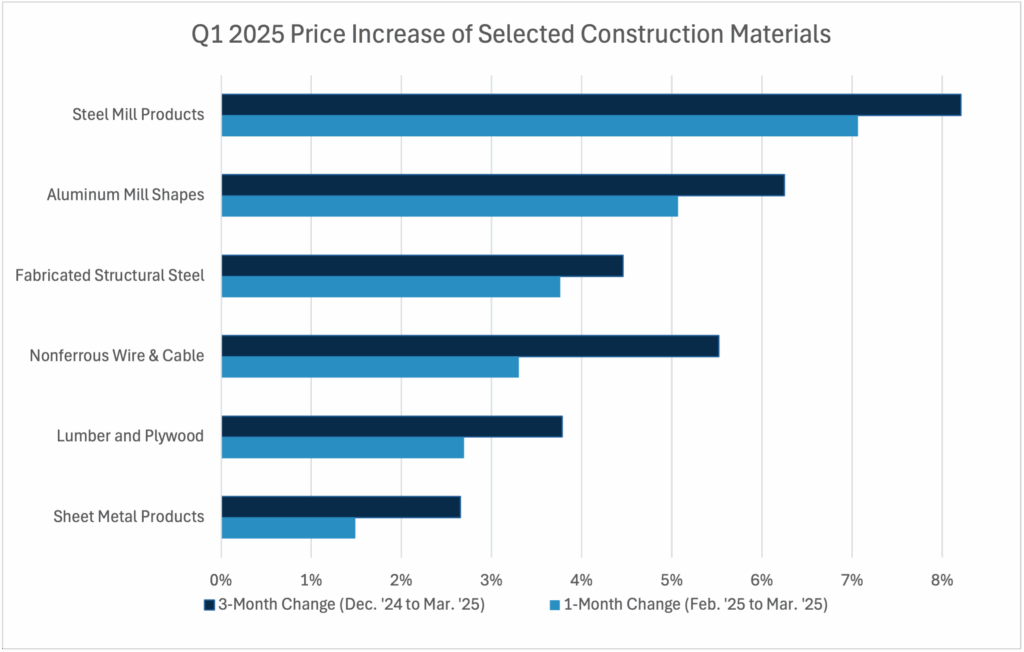

First quarter tariffs led to price increases for imported and domestically sourced construction materials, especially steel, aluminum, and wood products. Economic uncertainty around U.S. trade policy also likely delayed further interest rate cuts until at least the second half of this year.

Tariffs

The United States announced a rapid succession of new tariffs on imported goods during the first quarter of 2025. Effective March 12, 2025, the U.S. implemented a 25% tariff on all steel and aluminum imports. In addition to fabricated steel and aluminum, these tariffs apply to derivative construction products that incorporate imported steel or aluminum, such as doors, door and window frames, windows, tubing, fittings, tanks, fasteners, elevator parts, and construction machinery. Tariffs targeting other construction materials, such as copper, lumber, plywood, computer chips, and trucks, have also been threatened but not yet implemented. In addition to product-specific tariffs, during the first quarter the U.S. also imposed a 10% baseline tariff on all its trading partners, and country-specific tariffs on China (up to 145%), Canada (up to 25%), and Mexico (up to 25%), subject to certain exceptions.

This spate of tariff activity, and the expectation that it will continue, has led to higher prices and uncertainty for both imported and domestically sourced construction materials. For example, the U.S. Bureau of Labor Statistics (BLS) reported that the price of aluminum mill shapes rose 6.2% in the first quarter and 5.1% between February and March alone. Aluminum tariffs may impact both fabricated products (like handrails and ladders) and other aluminum building materials, including storefront windows and doors, signage, and metal panels. Carroll Daniel has already received reports of tariff surcharges on numerous other construction materials, including door hardware, HVAC equipment, and insulated metal panels.

Source: U.S. Bureau of Labor Statistics, Producer Price Indexes

Download the Q2 2025 Market Report

Click the button below to view and download the Carroll Daniel Q2 2025 Market Report.